Is Bitcoin Finally Going Mainstream?

The Growing Legitimacy of Crypto as an Asset Class

Bitcoin's journey from digital experiment to financial heavyweight has been nothing short of remarkable. After reaching a staggering market cap of $1.7 trillion at its peak, the burning question remains: has this former outsider truly earned its place at the grown-ups' table of legitimate asset classes?

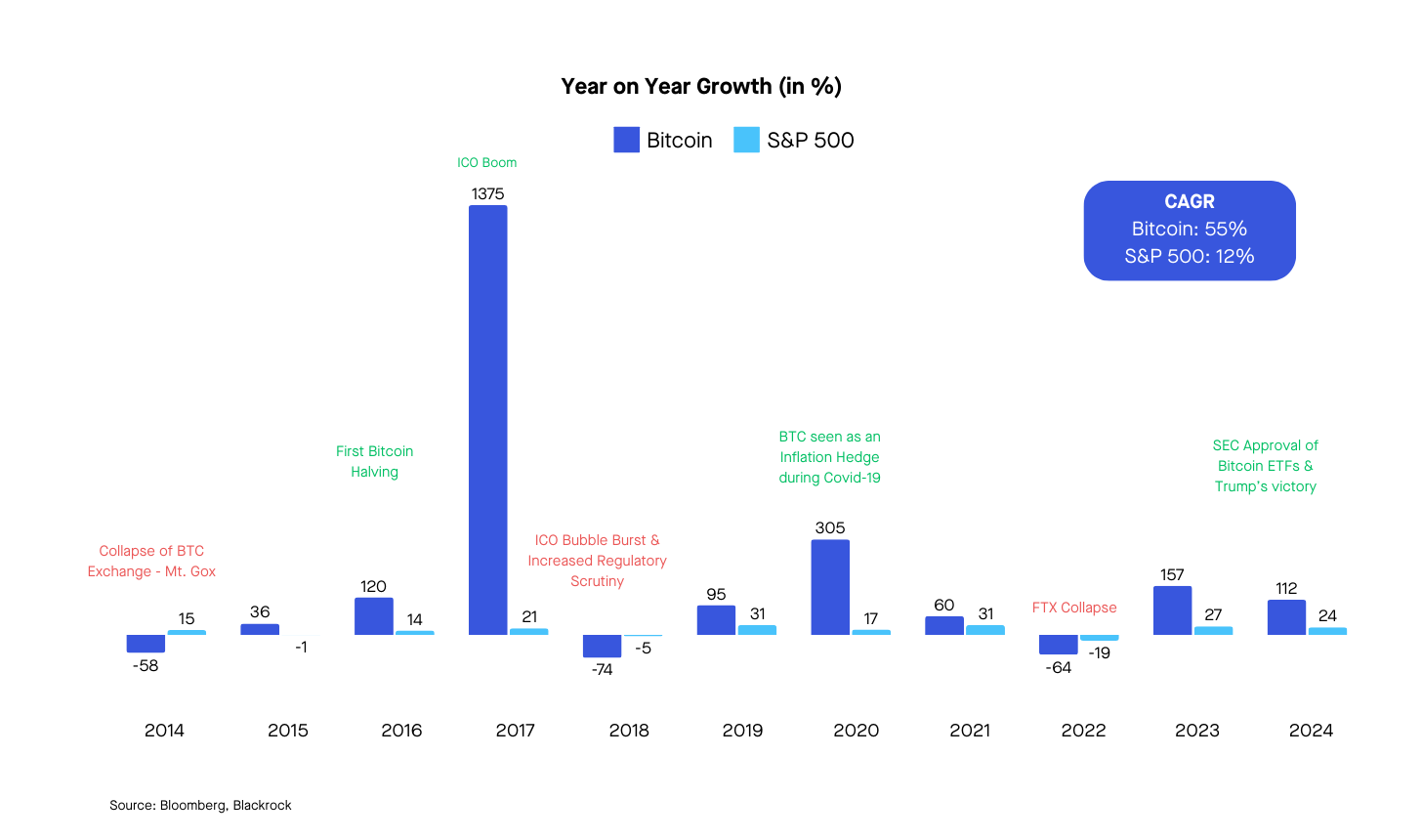

The exceptional performance of Bitcoin over the years is hard to ignore—it has delivered a compounded annual growth rate (CAGR) of 55% compared to the S&P 500’s 12% since 2014. Yet, the debate over its status as a mainstream asset is far from settled. The rise of crypto ETFs and increasing institutional adoption suggests growing acceptance, but persistent volatility and a mixed reputation have cast doubt on its long-term role in financial markets.

As the crypto landscape evolves, the interplay of regulatory changes, institutional backing, and policy shifts is shaping what could be a pivotal moment for Bitcoin’s future. The incoming Trump administration has indicated strong support for crypto development, suggesting plans to position the U.S. as a leader in the space. If these plans materialize, we could see a regulatory green light that turbocharges its adoption.

With growing institutional interest, undeniable returns, and a shifting regulatory landscape, investors are being pushed to confront more fundamental questions: Can Bitcoin mature into a stable, mainstream asset, or will its notorious volatility keep it confined to a high-risk, speculative corner of the market? How should investors approach crypto in their portfolios—as a reliable hedge against inflation, a diversification tool, or merely a high-stakes gamble?

Institutional Adoption and the Rise of Bitcoin ETFs

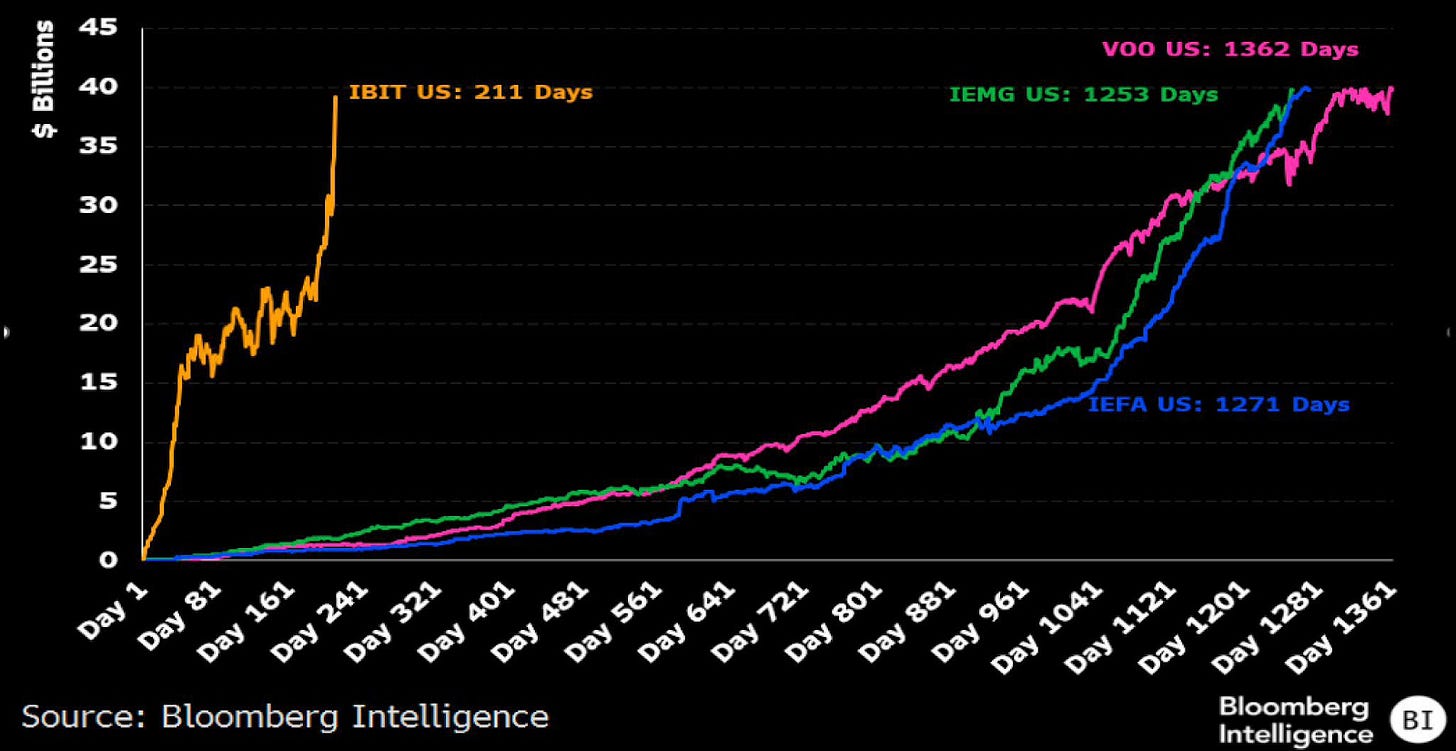

In a landmark move, the SEC approved 11 Bitcoin spot ETFs, with industry titans BlackRock (IBIT) and Fidelity (FBTC) launching their offerings in early 2024. This was a game-changer for the legitimacy of crypto, opening doors to significant capital inflows. On the first day of trading, U.S. Bitcoin ETFs attracted $4.6 billion in investments. By November 2024, cumulative investments in IBIT US had exceeded $40 billion, making it one of the most successful ETF launches in history based on the speed and scale of asset accumulation.

The entrance of institutional players lends some credence to the idea of Bitcoin as “digital gold.” Its limited supply and decentralized nature appeal to those concerned about inflation and economic instability. Larry Fink, CEO of BlackRock, recently referred to Bitcoin as an “international asset”, drawing parallels to the yellow metal. Another key driver accelerating institutional interest is its performance: Bitcoin has compounded returns at 55% since 2014, significantly ahead of traditional assets like the S&P 500. For long-term holders chasing alpha, Bitcoin and the broader Crypto market have become difficult to ignore.

Not everyone is a believer though. The SEC has challenged Bitcoin's "digital gold" narrative, emphasizing that Bitcoin lacks the features that make gold valuable to the central bank, including gold's established stability and its role as reliable emergency collateral. Vanguard has chosen not to offer Bitcoin on its trading platform. Tim Buckley, Vanguard’s Chairman and CEO, has expressed concerns over Bitcoin’s volatility and questioned its viability as a store of value. This reflects a broader hesitation among conservative investors. Bitcoin’s reputation as a hedge against inflation was also notably tested in 2022, when its value dropped by 64% during a period of high inflation.

Growing institutional participation and evolving regulatory frameworks are creating a more mature market infrastructure that could satisfy the skeptics over time, helping Bitcoin evolve beyond its current limitations. That major financial institutions are building long-term strategic positions signals mounting confidence in this emerging asset’s staying power.

The Geopolitical Landscape and Trump's Potential Impact

Geopolitical tensions, including the Russia-Ukraine war and deteriorating US -China relations have highlighted Bitcoin's unique position as a decentralized, borderless asset. Some nations are turning to cryptocurrencies to reduce reliance on the US dollar for international trade and reserves, fueling a broader trend toward de-dollarization. Countries like Russia, Iran, and Brazil have already started using cryptocurrency for specific cross-border transactions. With its dominant share of over 60% in total crypto market capitalization and a proven track record, Bitcoin is emerging as the leading contender for mainstream global adoption.

Investor enthusiasm over President-elect Trump’s second term has already pushed Bitcoin’s price past $90,000. Despite his earlier skepticism, his pledge to 'make the US the crypto capital of the world' signals a pivot, with plans to appoint pro-crypto figures to key regulatory positions. His top pick for Treasury Secretary, Scott Bessent, is a hedge fund investor with a known affinity for cryptocurrencies, particularly Bitcoin.

This shift could create a friendlier regulatory environment that might attract billions in additional capital inflows into the crypto market. While markets may need to weather some policy-driven volatility, clear regulations will pave the way for Bitcoin's sustained adoption over the long term.

Does Bitcoin Offer Diversification Benefit?

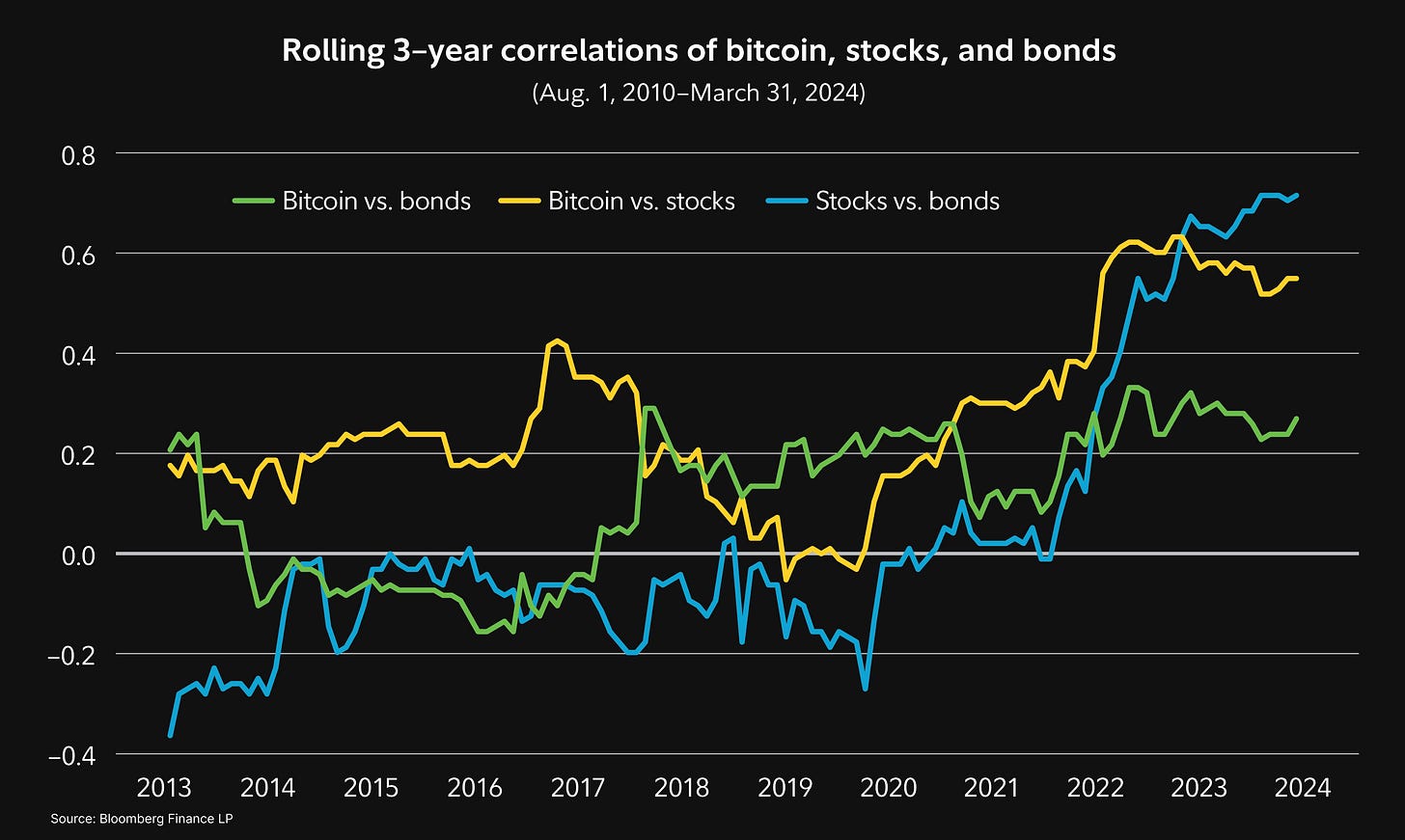

One compelling argument for adding Bitcoin to an investment portfolio is its unique behaviour. Its correlation with traditional markets is inconsistent, often moving independently, especially during economic shocks. Fidelity’s recent research on the matter highlights Bitcoin’s low long-term correlation with other assets, positioning it as a potential tool for diversification. During the most recent 3-year period in the chart below, bitcoin’s correlation with stocks was 0.53, and 0.26 with bonds. For investors seeking to reduce risk during economic uncertainty, Bitcoin could offer a way to increase portfolio independence.

This historical pattern, however, is also showing signs of change, with Bitcoin showing increased correlation to traditional markets since the pandemic. If this were to continue, the diversification benefit from owning Bitcoin could diminish. That said, the CFA Institute Research Foundation notes that even a modest 2.5% allocation to crypto assets can improve a portfolio's risk-adjusted returns. For more risk-tolerant investors, higher allocations of 5% or so could be made.

Practical Advice for Retail Investors: ETFs and Digital Platforms

For investors seeking Bitcoin exposure without the complexities of direct ownership, Bitcoin ETFs offer a regulated, familiar entry point through traditional brokerage accounts. As Bitcoin continues to mature, adopting strategic investment practices becomes crucial for navigating its volatility.

Tips for Investors

Invest what you can afford to lose: Crypto’s volatility is substantial, so ensure your investments align with your risk tolerance. While diversification can spread risk, remember that even diversified crypto assets are inherently speculative and volatile.

Use Dollar Cost Averaging (DCA): Mitigate market fluctuations by investing small amounts regularly, rather than making a single large purchase.

Choose a Trusted Exchange: Prioritize well-established exchanges with strong security protocols to minimize risks.

Stay up to date: Monitor cryptocurrency regulations, market trends, and technological developments in both your local jurisdiction and globally.

Wrapping up

Bitcoin and other cryptocurrencies have made significant strides toward mainstream adoption. Although their diversification benefits and gold-like status remain debated, one thing is clear: institutions are increasingly taking Bitcoin seriously. Evolving regulations under the Trump administration will be pivotal in shaping its future. For retail investors, taking a balanced approach—using Bitcoin ETFs and prudent position sizing can help navigate the risk-reward makeup of crypto investing. The key is to stay agile and informed as the market evolves.