Mastering Asset Class Types

How Asset Classes Shape a Balanced and Resilient Investment Portfolio

What Is an Asset Class?

An asset class is a category of investments that share similar characteristics, behave in a comparable way in the market, and are subject to the same regulations. While investments within the same class are not identical, they often move in the same general direction under similar conditions.

For US investors with $100K to $1M in assets, mastering asset class diversification is the foundation of long-term wealth growth and effective risk management. Each asset class, such as equities, fixed income, real estate, commodities, and alternatives, behaves differently across market cycles. Allocating strategically across them smooths volatility, captures growth opportunities, and protects capital.

If you are unsure of your risk tolerance and investment style, start by identifying your profile with our guide: Find Your Investor Type and Build Your Strategy.

Why Diversification Works

Different asset classes often have low or even negative correlation with one another, meaning they do not move in the same direction at the same time. This is the core reason diversification works: a downturn in one area can be offset by stability or gains in another.

Your asset allocation should also reflect your time horizon:

Long-term horizon: allocate more heavily toward growth assets like equities.

Short-term needs: allocate more toward defensive assets like cash, short-term Treasuries, or investment-grade bonds.

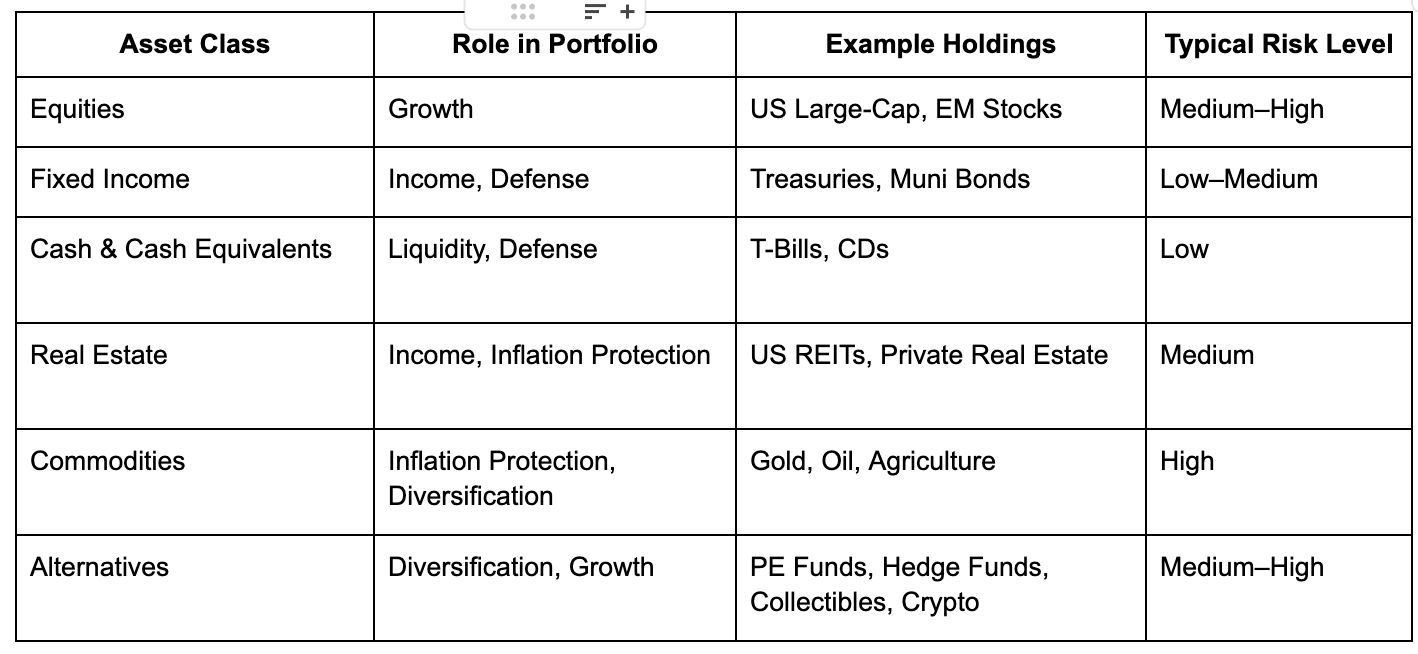

Primary Asset Classes and Their Roles

We have organized the main asset classes both by type and by role in a portfolio: growth, income, inflation protection, or defense. Many can serve multiple purposes.

1. Equities (Growth)

Ownership in a company, aiming for long-term capital appreciation and, in some cases, dividend income.

US Large-Cap Stocks: Stable, highly liquid, often household names (e.g., S&P 500 companies).

US Small-Cap Stocks: Higher growth potential but more volatile.

International Developed Stocks: Diversification into markets like Japan or the UK.

Emerging Market Stocks: Higher growth potential with greater political and currency risks.

Role: Primary growth engine of the portfolio.

Learn more: Strategic Equity Trading for insights into capturing equity market opportunities.

2. Fixed Income (Income & Defense)

Bonds and debt instruments providing predictable payments and portfolio stability.

US Treasuries: High-credit quality, defensive core holding.

Municipal Bonds: Tax-advantaged income for high earners.

Corporate Bonds: Higher yields with more credit risk.

High-Yield Bonds: Greater income with higher default risk.

International and Emerging Market Bonds: Diversification with currency and political risk.

Role: Stability, steady income, and downside protection.

3. Cash & Cash Equivalents (Defense & Liquidity)

Highly liquid, low-risk holdings designed for capital preservation.

Examples: money market funds, Treasury bills (T-bills), certificates of deposit (CDs).

Useful for short-term needs or as a dry powder reserve for opportunistic investing.

Role: Immediate liquidity and risk-free storage of capital.

4. Real Estate (Income & Inflation Protection)

Tangible assets offering income potential and inflation hedging.

US REITs: Commercial properties with mandated income distributions.

International REITs: Diversification into global property markets.

Private Real Estate Funds: Illiquid but with potentially higher returns.

Role: Steady income, diversification, and inflation hedge.

5. Commodities (Inflation Protection & Diversification)

Physical goods such as gold, oil, agricultural products, or industrial metals.

Typically accessed via ETFs, mutual funds, or futures contracts.

Role: Protection against inflation and diversification from equities and bonds.

6. Alternatives (Diversification & Growth)

Non-traditional assets often uncorrelated with public markets:

Private Equity & Venture Capital: Growth potential in private companies.

Hedge Funds: Flexible strategies with higher fees and complexity.

Collectibles: Art, rare stamps, and other valuable assets that are illiquid but potentially high-return.

Cryptocurrency: Highly volatile and speculative; allocate only if it aligns with your risk profile.

Role: Diversification and return enhancement.

Advanced Instruments: Options and Futures

Not asset classes themselves, but powerful tools for managing risk or enhancing returns:

Options: Right (not obligation) to buy or sell an asset at a set price before expiration.

Futures: Obligation to buy or sell an asset at a set date and price.

Best used selectively and generally not suitable for beginners.

Portfolio Diversification Techniques

Mix roles, not just types: Combine growth (equities), defense (cash, Treasuries), income (bonds, REITs), and inflation protection (commodities, TIPS).

Think correlation: Include assets that do not move together.

Adjust over time: As you approach financial goals, shift toward more defensive allocations.

Tax-Efficient Asset Allocation

Place assets where they are taxed most efficiently:

Tax-Deferred Accounts (IRA, 401(k)): High-yield bonds, REITs, actively traded funds.

Taxable Accounts: Index funds, growth stocks, municipal bonds.

Learn more: Cut Your Tax Bill with Smart Tax Allocation.

Inflation Hedge Investments

TIPS: Bonds whose principal adjusts with inflation.

Real Estate: Rents can rise with inflation.

Commodities & Precious Metals: Often move with inflationary trends.

Quick Reference Table

Conclusion & Next Steps

Understanding asset classes and the roles they play is essential for constructing a portfolio that matches your financial goals, time horizon, and risk tolerance. With Finvest, you gain expert guidance, data-driven allocation strategies, and tools tailored to your $100K to $1M wealth objectives.

Start building your resilient portfolio today. Download Finvest to discover opportunities and get smart insights on your situation.

Frequently Asked Questions (FAQ)

1. What is the safest asset class?

Cash and cash equivalents, such as Treasury bills or insured certificates of deposit, are generally considered the safest because they preserve capital and are highly liquid. However, their returns are typically lower than other asset classes, which means they may not keep up with inflation over the long term.

2. Which asset class has historically delivered the highest returns?

Over the long term, equities have outperformed other asset classes. For example, the S&P 500 has delivered an average annualized return close to 10% over the past century. This higher return potential comes with greater short-term volatility.

3. How often should I rebalance my asset allocation?

Most investors benefit from reviewing and potentially rebalancing their portfolio at least once a year, or when market moves significantly change the weightings of your asset classes. This ensures your portfolio remains aligned with your risk tolerance and goals.

4. What percentage of my portfolio should be in alternatives?

For most mass affluent investors, alternatives such as private equity, hedge funds, or collectibles should make up a smaller portion of the portfolio, typically under 15–20%, depending on your risk profile and liquidity needs.

5. Are cryptocurrencies a legitimate asset class?

Many experts classify cryptocurrencies as part of the alternatives category. While they can offer diversification benefits, they are highly volatile and speculative. Allocate only if it aligns with your risk profile and financial plan.

6. How can I invest in a tax-efficient way?

Place tax-inefficient assets like REITs or high-yield bonds in tax-deferred accounts, and keep tax-efficient assets like index funds or municipal bonds in taxable accounts.

- Written by Corentin HUGOT, Finvest's Chief of Staff -