Why Millennials Are Scared of Buying Real Estate

How economic uncertainty and soaring prices are reshaping a generation's view of the American Dream

These days, for millennials, buying a home feels less and less like achieving the American Dream and more like taking a high-stakes gamble. This experience can be a large source of stress, mentally and emotionally, that can put an entire generation off from the idea of buying their dream house.

Due to circumstances outside of their control, housing trends have continuously reshaped millennials’ perspectives on real estate – and not in a good way – influenced by broader economic and societal shifts. Now more than ever, millennials are seeing the home buying journey with some skepticism and caution, all driven by unique generational experiences and challenges.

So what exactly is putting this sense of fear into their heads? And where does the path to homeownership go from here?

The Legacy of 2008: Growing Up in a Crisis

The Great Recession in 2008 has had a big impact on millennials, and many are still handling the aftermath in their lives. This crisis took a toll on them, affecting:

Job Market: Unemployment was higher for millennials compared to older age groups during the 2008 recession. For instance, for those aged 16 to 24, the unemployment rate surged by eight percentage points between the fall of 2007 and the fall of 2009, reaching a high of 19%. Many millennials finished university during this period, resulting in high student debt and a difficult time finding work.

Savings: Struggling with significant student loan debt while entering a tough job market forced many millennials to prioritize debt payments over saving for retirement or home-ownership. This had lasting consequences - In 2020, only 49.5% of millennials had at least one retirement account vs 58% for baby boomers.

Foreclosure Rates: In 2007, lenders began the foreclosure procedure on approximately 1.3 million properties, increasing to 2.3 million in 2008 – all taking place when millennials were in their 20s.

The Great Recession of 2008 broke the conventional idea of real estate being a guaranteed method of stability and wealth, replacing it with caution and distrust. Exposure to these risks at a young age resulted in millennials becoming wary of their parent’s financial miscalculations.

COVID’s Housing Boom: The Fear of Overpaying

The COVID pandemic introduced a different type of housing market disruption. While cities started locking down and remote work became normalized, the demand for homes rose exponentially. Along with historically low interest rates, this started a surge in housing prices that left many millennials feeling left out or hesitant to enter the housing market.

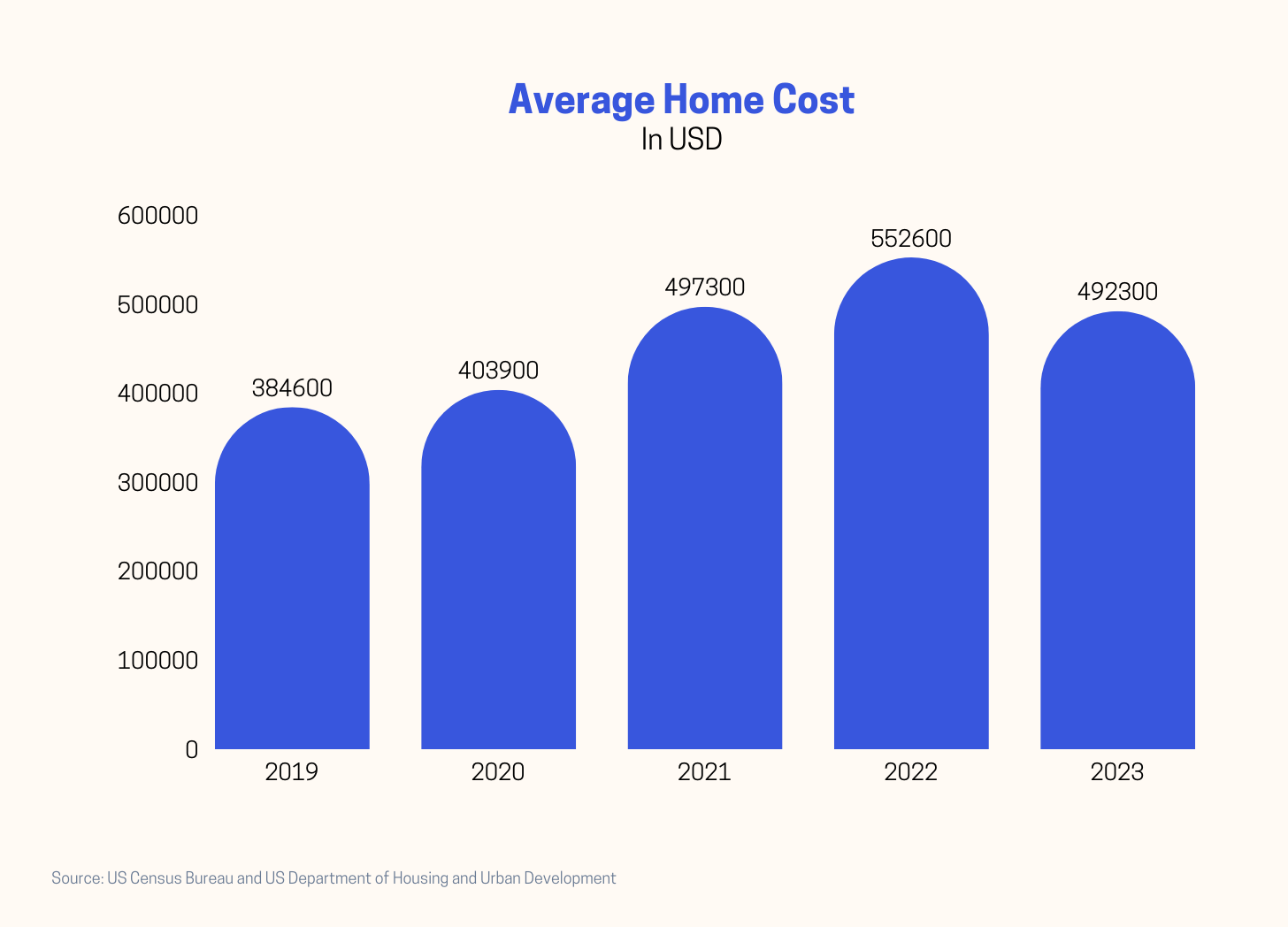

The average home price rose from approximately $384,600 at the end of 2019 to roughly $552,600 at the end 2022, representing a significant increase in just two years.

After the end of the pandemic, stories of buyers regretting their purchases were being shared as home values plateaued or declined in specific markets. The results from the 2024 Millennial Home Buyer Report continue to signal disappointment with 90% respondents having regrets about their first purchase. For those who waited to buy a home, increased mortgage rates has added more anxiety to the mix as monthly payments have become less affordable.

Lower Returns and Reduced Affordability

As the pandemic-fueled frenzy subsided, millennials were left grappling with a larger question: is homeownership still a smart financial decision? Unlike their parents, who likely see homeownership as a reliable investment, millennials are approaching the housing market with caution. Home pricing volatility over the past two decades reinforced the belief that real estate isn’t a safe bet anymore.

For example, the CEIC estimates that the US house prices have grown at a CAGR of 5.5% between March 1992 and Sept 2024. In contrast, the S&P 500 has clocked returns of ±10% (including dividends). The lower returns combined with added costs of homeownership like property taxes, maintenance, and loan interest expenses has made millennials skeptical about this asset class as an investment vehicle.

Beyond the investment considerations, millennials are also facing a severe affordability crisis. Despite being the most educated generation in history, they face stagnant wages that aren't keeping pace with rising real estate prices. The gap is striking: from 2000 to 2022, home prices jumped 162%. To afford a median-priced home, Americans needed an annual income of approximately $166,600 - but the median household income was $74,580.

The affordability crisis hits hardest in urban areas, where most millennials work. Even those following sound financial practices – saving consistently, maintaining good credit, and earning decent salaries – struggle to compete in a market dominated by cash offers and bidding wars. The traditional path to homeownership through careful saving and budgeting no longer guarantees success in today's real estate landscape.

Rewriting the Homebuying Narrative

For millennials, homeownership is no longer just a milestone—it’s a calculated decision shaped by unique financial and emotional challenges. Social media often glamorizes the idea of owning the "dream home," setting unrealistic expectations that can make the process feel daunting. At the same time, the tendency toward analysis paralysis—overthinking and second-guessing every decision—has caused many to hesitate, unsure of the right path forward. This fear of making the wrong choice not only leads to missed opportunities but can also leave millennials feeling trapped in a cycle of doubt and uncertainty about their future.

For millennials, homeownership has evolved into a deliberate choice centered on financial stability, personal priorities, and informed planning—a move away from the traditional 'dream home' narrative. For those who choose to buy, the key lies in exploring flexible solutions, like relocating to more affordable areas, co-buying with friends or family, or waiting for the right market conditions.

The journey may not mirror that of previous generations, but it offers a chance to reimagine the American Dream in a way that aligns with current realities. Whether you're buying now or planning for the future, the most important step is to approach the process with knowledge, patience, and confidence.

Team Finvest